Interruption Insurance Coverage and What It Can Do for You

6/26/2019 (Permalink)

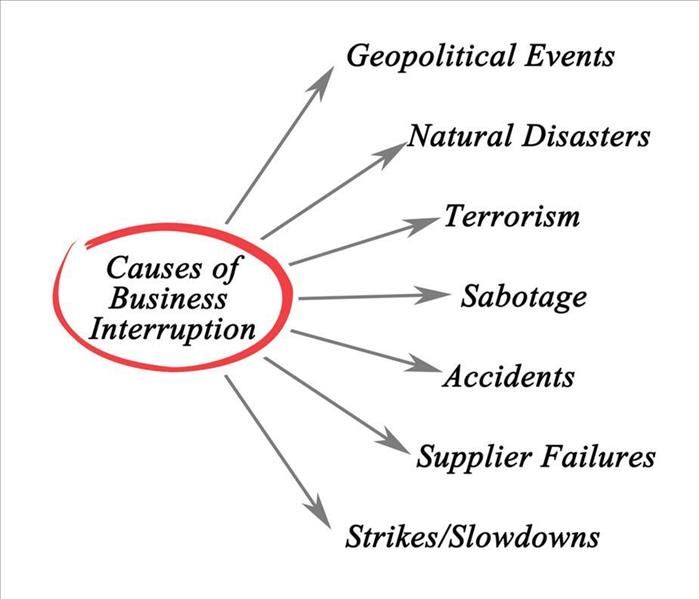

You’ve worked hard to establish your company in Hardin Valley, TN, and as a result, business is going well. Have you considered, however, what you would do in the unfortunate event that a fire or a natural disaster ravaged your facility, temporarily putting you out of business? Interruption insurance coverage on your business policy, also known as business income coverage, is valuable and will make it easier for you to resume business by compensating you for loss of income or profits during the business interruption.

What Is This Insurance?

Business income coverage provides compensation for the following:

- Profits that could have been earned had this loss not occurred

- Normal operating expenses while the business is closed, including employees’ wages

- The cost of relocation to a temporary site in order to conduct business

This type of insurance applies when a fire or other property damage covered under the insurance policy causes a business to reduce or completely stop operations. While property insurance may cover the actual damage to the building, it does not cover the loss of income or profits resulting from the diminished business operations. During the time the property damage is being repaired or replaced, interruption insurance is in effect.

What About Additional Expenses?

An additional coverage, known as extra expense coverage, may be included with the business income coverage. It applies to additional expenses unrelated to the actual damage, such as the higher cost of rent at a temporary site used to conduct business.

What Should I Do After I Call My Insurance Company?

Hopefully, a fire will never erupt at your office or facility, making it necessary for you to ever have to use your business income coverage. In the event that it does, however, a company specializing in fire restoration is Here to Help and can make your working area look “Like it never even happened.”

Interruption insurance coverage is a valuable resource for the business owner. Along with extra expense coverage, this insurance provides peace of mind and enables a company to proceed with business more effectively during a time of transition.

24/7 Emergency Service

24/7 Emergency Service